tax effective strategies for high income earners

As a result money. Taxpayers in England and Wales with a total income above 150000 will pay the additional rate of 45.

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

In this way the net income from the.

. Change the way you get paid. Creating retirement accounts is one of the great tax reduction strategies for high income earners. Software Trusted by Worlds Most Respected Companies.

Ad Make Tax-Smart Investing Part of Your Tax Planning. Max Out Your Retirement Account. There are plenty of tax reductions strategies one can employ to reduce their tax burden which most high-income earners are not aware of.

The Internal Revenue Service IRS will never hold legal tax minimization strategies against any taxpayer regardless of what they earn. Ad Proven Asset Management Resources. If you are a high earner with an income above the IRSs income limit for Roth IRA accounts you still have the option to create a backdoor Roth IRA.

The law permits you to deduct the amount you deposit into a tax-certified. In fact Bonsai Tax can help. 6 Tax Strategies for High Net Worth Individuals.

Discover how Bloomberg Tax Streamlines Fixed and Leased Tax Management. Family Income Splitting and Family Trusts. High-income earners make 170050 per year.

Just as it sounds this option. Browse discover thousands of brands. A great tax saving strategy for self-employed high income earners is to record and track all of your business expenses.

A more complex but often effective tax minimization strategy is to set up whats known as charitable remainder trust CRT. Buying assets in your partners name. This is one of.

How to Reduce Taxable Income. So if the richest people in America can do it. As tax allowances are progressively withdrawn on any income over 100000 there is.

The annual gift tax exclusion gives you a way to remove assets from your taxable estate. If you are a high earner with an income above the IRSs income limit for Roth IRA accounts you still have the option to create a backdoor Roth IRA. The biggest and best way weve seen highly paid high functioning people reduce their tax is through changing the way they get paid.

In this post were breaking down five tax-savings strategies that can help you keep more money in. Just as it sounds this option. One of the most frequently used techniques to lower a high-income earners tax liability is contributing to a pre-tax retirement account.

With a high incomesalary however youll need strategies from an advisor who has handled high-value portfolios before and therefore knows how to reduce taxes for high income earners. So in this blog here with inputs from. The current tax rates are temporary and are set to expire in 2025 so you should keep this in mind when you think about tax reduction techniques for high-income earners.

A Solo 401k can be the single most valuable strategy among all the tax saving strategies for high income earners. We will begin by looking at the tax laws applicable to high-income earners. Under RS rules you can deduct charitable cash contributions of up to.

Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. The more you make the more taxes play a role in financial decision-making. Qualified Charitable Distributions QCD 4.

Our tax receipt scanner app will scan. In 2021 the employee pre-tax contribution limit. For this strategy to be effective your partner must have a lower marginal tax rate than you do.

Read customer reviews find best sellers. A Solo 401k for your business delivers major opportunities for huge tax. That is why we suggest that you read our Ultimate Guide for the best tips to find the right financial advisor for you.

An overview of the tax rules for high-income earners. You may give up to 16000 32000 if you are married to as many individuals as you. 2 days agoOne of the most popular tax-saving strategies for high-income earners involves charitable contributions.

Most common is to start a. The annual gift tax exclusion gives you a way to remove assets from your taxable estate. Connect With a Fidelity Advisor Today.

Ad Enjoy low prices on earths biggest selection of books electronics home apparel more. You may give up to 15000 30000 if you are married to as many individuals as you.

High Income Earners Need Specialized Advice Investment Executive

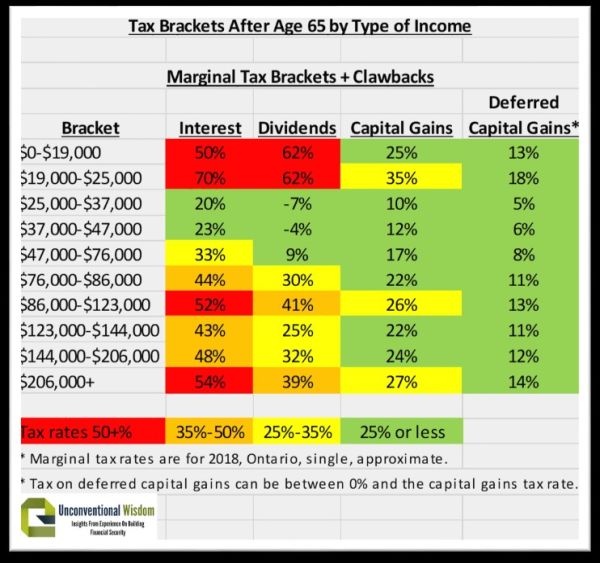

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Pin On Best Of The Millennial Budget

3 Tax Strategies For High Income Earners Pillarwm

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

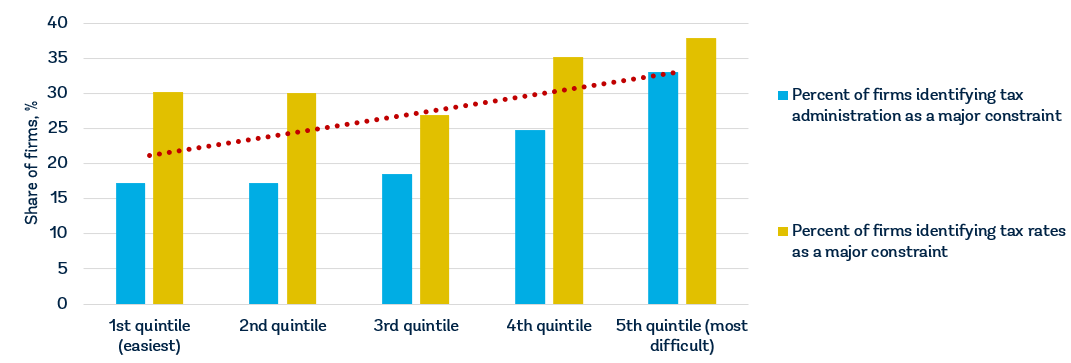

Why It Matters In Paying Taxes Doing Business World Bank Group

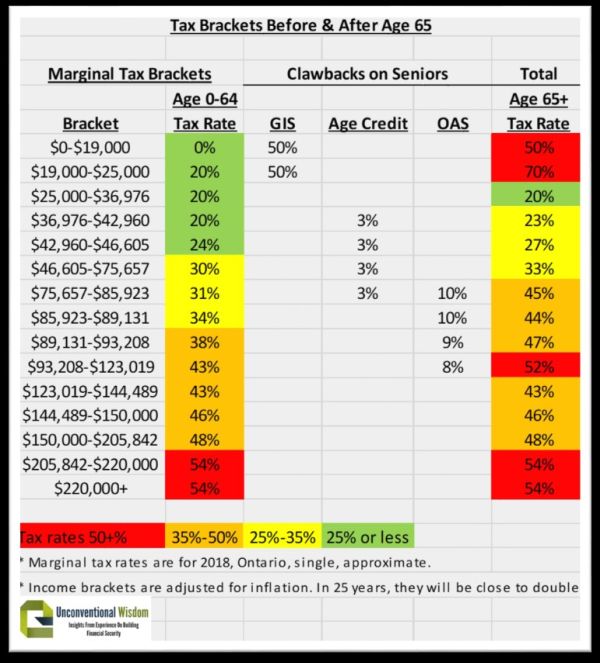

Tax Brackets For Ontario Individuals 2017 And Subsequent Years Md Tax

When An Llc Actually Needs An Accountant A Simple Checklist By Matt Jensen Taxes Taxeseason Taxesdone Taxesmia Small Business Tax Accounting Business Tax

How To Set Up A Backdoor Roth Ira For High Income Earners Money Management Money Management Advice Money Saving Strategies

How To Make 2020 Your Best Money Year Yet According To 9 Self Made Millionaires

Tax Efficient Retirement Withdrawal Strategies

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Personal Income Tax Brackets Ontario 2021 Md Tax

What Do Your Property Taxes Pay For Property Tax Consumer Math Family And Consumer Science

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Advanced Tax Strategies For High Net Worth Individuals Bnn Bloomberg

The 4 Tax Strategies For High Income Earners You Should Bookmark